Frontrunning: May 16

- European Stocks Fall as Chinese Economic Data Disappoint (WSJ)

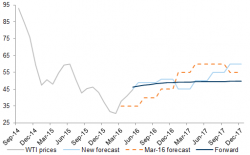

- Oil Climbs to Highest Since November as European Shares Retreat (BBG)

- Yen weakens on Japan intervention talk before G7 meets (Reuters)

- Wall Street’s Bond Forecasters Splinter as Fed Credibility Wanes (BBG)

- Amazon to Expand Private-Label Offerings—From Food to Diapers (WSJ)

- Oil prices rise on Nigerian outages, Goldman forecast (Reuters)

- 'Avengers' threaten new insurgency in Nigeria's oil-producing Delta (Reuters)