The Coming Fiscal Derailment - Stockman Explains Why FY 2019 Will Sink The Casino

Authored by David Stockman via Contra Corner blog,

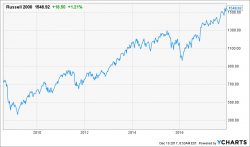

Since last November 8th the Russell 2000 has risen by 30% and the net Federal debt has expanded by an astounding $1.0 trillion dollars.