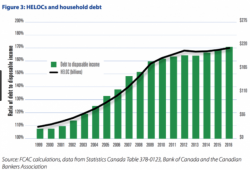

Canadian Homeowners Take Out HELOCs To Fund Subprime Purchases

Authored by Steve Saretsky via VanCityCondoGuide.com,

The HELOC (Home Equity Line of Credit) has been a blessing and a curse for Canadian households. While it has helped spur house prices and simultaneously provided consumers the ability to tap into their new found equity, it has also crippled many Canadian households into a debt trap that seems insurmountable.

Between 2000 and 2010, HELOC balances soared from $35 billion to $186 billion, according to the Financial Consumer Agency of Canada, an average annual growth rate of 20%.