Seasonality, US Production, Rig Counts and Gasoline Demand

By EconMatters

Citi Research fails to address the Fundamentals side of the equation, the Doha Meeting is Meaningless in the overall scope of the Oil Market.

By EconMatters

Citi Research fails to address the Fundamentals side of the equation, the Doha Meeting is Meaningless in the overall scope of the Oil Market.

Submitted by Eugen von Bohm-Bawerk via Bawerk.net,

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth.

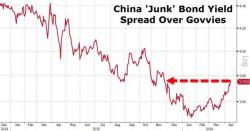

In January we pointed out "the last bubble standing," as China's crashing equity market had spurred massive inflows - directed by a "well-meaning" central-planning committee's propaganda - sparking a massive bubble in Chinese corporate bond markets (in an effort to enable desperately weak balance-sheet firms to roll/refi their debt and keep the zombies alive). That has now ended as China's junk bond risk has soared to 5-month highs with its worst selloff since 2014. As HFT warns, "we should avoid junk bonds."

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Asher Edelman just penned a powerful endorsement of Bernie Sanders in the The Guardian titled, I’m the real-life Gordon Gekko and I support Bernie Sanders.

So who is Asher Edelman? According to the paper:

For many months we have covered the "world's most bearish hedge fund", Horseman Global, which over the past several months (and years) has had a stunning run and has generated unprecedented returns (even as it has maintained a net short exposure for the past 4 years) and just last month, after returning 9.6% YTD went record short with a -88% net exposure.