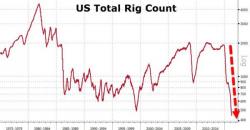

Crude Oil Prices Rise On New Record Low US Rig Count

With all eyes on Doha this weekend, today's rig count data may have even less signaling power than normal. The US oil rig count has risen for only one week this entire year and continues to track lagged crude prices lower, dropping 3 to 351 (lowest since Oct 09). With gas rigs unchanged, the total rig count dropped once again to a new fresh record low at 440. The reaction in crude oil prices was a small bounce.

- *U.S. GAS RIG COUNT UNCHANGED AT 89 , BAKER HUGHES SAYS