Why The Goldman Sachs Settlement Is An "Abomination And Insult To All Americans"

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

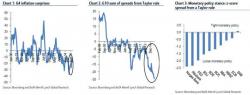

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first.

The market has started testing the central banks

My 15 year old son and I went to the NY Hedge Fund Roundtable event on the energy sector at the Penn Club last week. It's good to have your children see you perform. The discussion surrounded the price of oil, LNG and the impact Elon Musk is having on the oil industry.

Stephen Schork of the Schork report was the standout personality of the panel (buyside vs sellside panelists) basically echoing what yours truly has been telling you.

Submitted by Jeffrey Snider via Alhambra Investment Partners,

As one veteran trader told us, this massive short-squeeze came "out of nowhere," seemingly driven by oil-headline-induced algo momentum ignition. Goldman's "Most Shorted" stocks are up a stunning 6% in the last 2 days - the biggest 2-day surge since Oct 2015 as Credit Suisse noted earlier there is a "lot of pain being felt out there on the short side."

The face-ripping surge has sent "Most Shorted" stocks back into the green for the year...