Warning From The World's Biggest Shipping Line On Outlook for World Trade

The optimism on world trade didn’t last very long.

The optimism on world trade didn’t last very long.

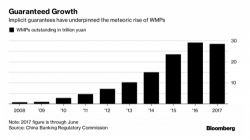

In November, we discussed how the post-Party Congress measures to deleverage and crackdown on the worst abuses in China’s credit bubble took an important step forward with the announcement of a new era of regulation for China’s $15 trillion shadow banking and asset management industry. See "A New Era In Chinese Regulation Means Turmoil For $15 Trillion In China's Shadows". In particular, the authorities turned their sights on wealth management products (WMPs).

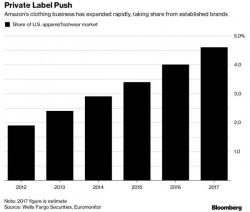

Despite daily affirmations from the White House that "everything is awesome" with the economy, 2017 has been a miserable year for retailers. As Reorg First Day points out, over 30 retailers, with debt aggregating into the billions of dollars, have filed for bankruptcy so far this year...

After Shiekh Shoes' filing today, at least 30 retail chains have filed for chapter 11 relief thus far in 2017: pic.twitter.com/7cLZXXFecl

— Reorg First Day (@ReorgFirstDay) November 29, 2017

Authored by Jeff Thomas via InternationalMan.com,

In 1791, the first Secretary of the Treasury of the US, Alexander Hamilton, convinced then-new president George Washington to create a central bank for the country.

Secretary of State Thomas Jefferson opposed the idea, as he felt that it would lead to speculation, financial manipulation, and corruption. He was correct, and in 1811, its charter was not renewed by Congress.

On Monday, HSBC announced its deferred prosecution agreement with the US Department of Justice (DoJ) had expired, removing the threat of criminal prosecution for money laundering which had been hanging over the company for five years. From the Financial Times.