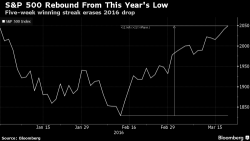

"A Dreaded Scenario For Oil Bulls Is Becoming A Reality" Reuters Warns: U.S. Production Is Coming Back On Line

One month ago, as we pounded the table on the biggest threat to the fundamental case for oil, namely that even a modest rebound in oil prices could unleash another round of production by the "marginal", US shale oil producers, we warned that a rebound in the price of oil as modest as $40 per barrel, could be sufficient to get drillers to resume production.