Profit Margins Tumble To Lowest In Four Years... And It's Not Just Oil's Fault

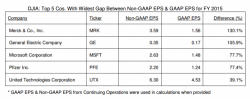

One week ago, we were surprised to see that none other than data aggregator Factset has joined the "crusade" against fabricated non-GAAP numbers. This is what it said:

One week ago, we were surprised to see that none other than data aggregator Factset has joined the "crusade" against fabricated non-GAAP numbers. This is what it said:

Submitted by Roger Barris of Economic Man, by way of Acting-Man

A Lack of “V”

After the February jobs report, President Obama said “America’s pretty darn great right now.” He then went on to disparage the “doomsday rhetoric” of the Republicans, which he said was pure “fantasy.

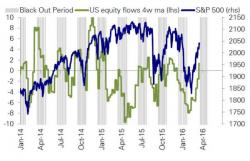

Last week, one day before the Fed unleashed a statement that stunned Wall Street by its dovishness and admission that the Fed had been far too optimistic on the state of the US (and global) economy, when it slashed its forecast on the number of rate hikes from 4 to 2, we said that "while everyone's attention is on the Fed, the biggest danger to the S&P500 has little to do with what Janet Yellen may say tomorrow, and everything to do with the marginal buyer of stocks being put into a state of forced hibernation", namely the start of the stock buyback blackout period during Q1 earnings se

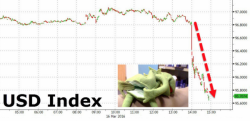

“The dollar rally is far from over,” Goldman’s Robin Brooks said, just hours before this week’s FOMC announcement.

“We expect the Fed to signal that it wants to continue normalizing policy, which means three hikes this year and four in 2017,” Brooks continued. “Overall, our sense is that the outcome will be more hawkish than market pricing.”

Earlier this month, a reader noticed something rather disturbing. Piraeus Bank seemed to have added a new line item in one of its reports and that new line item appeared to suggest that the bank was set to charge customers for exchanging €500 notes for smaller bills.

And it wasn’t just Piraeus. Other Greek banks looked to be doing something similar.