This Simply Does Not Compute: If Caterpillar Data Is Right, The Industrial Depression Has Never Been Worse

It has been over half a year since we first downgraded the industrial recession to an all-out global depression by using Caterpillar retail sales data, which have been so counterintuitive to what the company's earnings have been reporting that last September we had to ask "What On Earth Is Going On With Caterpillar Sales?."

Today, we must admit that something simply does not compute.

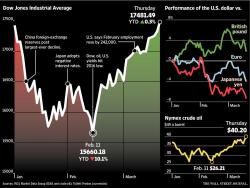

On one hand, CAT stock has soared by over 30% from its 2016 lows....