One Angry Trader Rages..."Nothing Can Possibly Go Wrong...Go Wrong...Go Wrong"

As stocks do things they have never done before (in terms of gains and complacency), despite the "inexplicable" collapse in the yield curve (and slump in earnigs expectations), some, like former fund manager Richard Breslow, are growing frustrated with the farce.

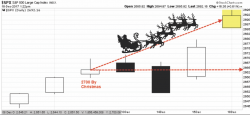

2017 is on track to be the first 'perfect year' with 12 consecutive monthly total return gains for the S&P 500

But the yield curve is collapsing?

And so have earnings expectations...