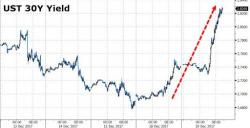

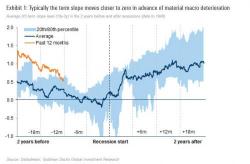

What The Yield Curve Says About The Timing Of The Next Recession

While most financial professionals would enjoy nothing more than to trade bitcoin all day long - after all it only goes up in the long run (for now), while bringing insane volatility with it - the reality for most is that they are confined to such boring, established legacy instruments as Treasurys, which rarely have intraday fireworks similar to those in bitcoin.