Goldman: "The S&P 500 Is Overvalued"

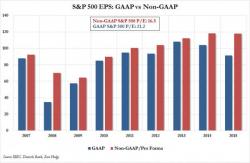

Three weeks ago, when looking at the incoming Q4 results, we were stunned by an unprecedented divergence: that of GAAP and non-GAAP earnings. We showed this difference as follows:

... and noted that while on a non-GAAP basis, the S&P's trailing P/E is a relatively rich 16.5x (over 17x as of today), it was the GAAP P/E that was troubling, because at just 91.5 in actual S&P EPS, this implies that the GAAP P/E of the overall market is now a near-record 22x.

We showed the delta between GAAP and non-GAAP as follows: