Why Despite Today's Market Surge, Bank of America Stubbornly Refuses To Join The Rally

Yesterday, it was risk off, and the litany of complaints aimed at "Blooper Mario" and the ECB's disappointment was relentless; then after supposedly "reassessing" what the ECB really announced, we have shifted to a global risk on euphoria and this morning pundits can't find enough praise for "Super Mario."

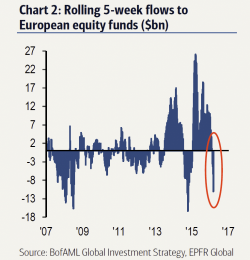

And yet one strategist refuses to flop to yesterday's flip: BofA's credit strategist Michael Hartnett, who has been urging to sell this rally for the past few weeks, and who continues to do so today. Here's why.