What We Know About Draghi's Coming Corporate Bond Purchases: The Winners And Losers

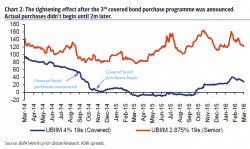

In our snap assessment of the ECB's decision yesterday, we highlighted some of the key highlights: the most important part of Draghi's monetary expansion was the inclusion of investment grade non-fin European corporate bonds, a necessary precondition to expanding QE by €20BN due to the scarcity of treasury collateral; the total €1.6 trillion universe of eligible Investment Grade bonds while sizable, is actually far less than it appears on the surface, that there is a "crowding out" danger as traders rush to sub-IG debt which may impair liquidity in the IG bond market next, and that many que