The Incredible Story Of How Hackers Stole $100 Million From The New York Fed

The story of the theft of $100 million from the Bangladesh central bank - by way of the New York Federal Reserve - is getting more fascinating by the day.

The story of the theft of $100 million from the Bangladesh central bank - by way of the New York Federal Reserve - is getting more fascinating by the day.

The last time that global liquidity conditions contracted at this pace was March 2008 (right as stocks dead-cat-bounced on the back of The Fed's guarantee of Bear Stearns' sale to JPMorgan)... and things escalated rather quickly thereafter.

Liquidity conditions also contracted (though not as severely as the current conditions) in Dec 2011... which prompted Bernanke to unleash QE2...

h/t financialsense.com

Bloomberg defines BofAML's Global Liquidity Tracker as follows:

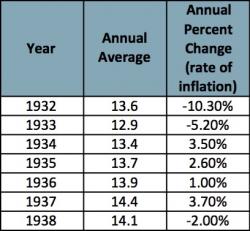

It’s literally 1937 all over again.

Many analysts have called for the Fed not to repeat its mistake of 1937.

That mistake?

Raising rates when the economy was already weak. Doing this prolonged the Great Depression.

However, few commentators point out WHY the Fed raised rates in 1937.

The reason?

CPI hit 3.7%.

Notice that by raising rates the Fed kicked off another terrible round of deflation with CPI falling from 3.7% to -2.0% in JUST ONE YEAR.

Fast forward to today. The US’s inflation rate is moving vertical…

Submitted by Dave Forrest via OilPrice.com,

China has been an unofficial price-setter for most metals over the past decade. And this week, the country became an official participant in setting prices for one of the world’s most important precious metals markets.

That’s the London Bullion Market silver price. Where one of China’s largest banks just became a member of an elite group of players that controls fluctuations in this key metal.

And so things are back to normal: following yesterday's unexpectedly poor 10 Year auction, which tailed notably while the bid to cover dipped despite it trading at the -3.00% fails rate in repo, moments ago the Treasury sold $12 billion in a 30Y reopening of Cusip RQ3, at a yield of 2.72%, stopping through the 2.731% When Issued by 1.1 bps, the most since mid-2015.

This was explainable considering the repo rate ahead of today's auction was a whopping -1.50%, which as the chart below shows, was the lowest on record.