Bear Market Rally Support Level Is Gone

The trend was your friend... until it came to an end...

and close up...

What happens next?

The trend was your friend... until it came to an end...

and close up...

What happens next?

Submitted by David Stockman via Contra Corner blog,

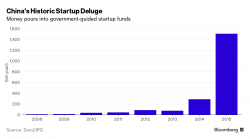

The desperate suzerains of the Red Ponzi are incorrigible. There appears to be no insult to economic rationality that they will not attempt in order to perpetuate their power, privileges and rule.

So now comes the most preposterous gambit yet. Namely, a veritable tsunami of state handouts to foster, yes, capitalist entrepreneurs!

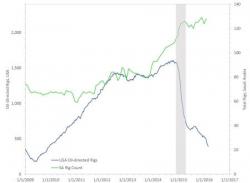

Submitted by Dwayne Purvis via OilPrice.com,

In the geopolitical and oligopolistic global oil market, purely financial supply and demand has often been a secondary force, acting when it is allowed to act. It is the strategic behavior of the producing titans, not their talk or the slow-motion supply-demand balance, which has the real power to move markets. That is the case in the last two years and remains the case in 2016.

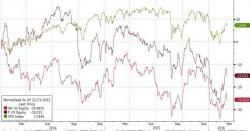

"Everyone is offside," exclaimed one trader we talked to, noting the swings in EURUSD and stocks have tagged stops everywhere. Dow futures are now down 300 points from Draghi highs with S&P futures breaking below the crucial 1980 trendline support. As the trader concluded, "it's a bloodbath."

Not what everyone was expecting...

Ramp is over...

Since the end of 2013, US automaker stocks have dramatically underperformed the market.

This bewildered many as auto sales surged on the back of easy credit and the entire industry was proclaimed a great success. However, the reason for the underperformance is simple - stock investors discount the future and with a mal-investment-driven excess inventory-to-sales at levels only seen once before in 24 years, they know what is coming next.