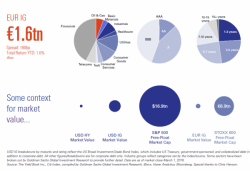

This Is The $1 Trillion In European IG Bonds Which The ECB Is Now Buying

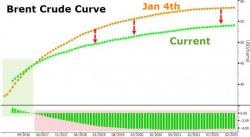

Ever since the start of ECB's QE, one of the biggest concerns has been how will the ECB continue monetizing €60 billion in debt in a market that is increasingly illiquid and running out of collateral. Moments ago we got the answer when the ECB not only went even deeper into negative rates territory, cutting all three of its main rates, but boosted QE by €20BN.