Do Any Of The Current Rallies Pass "The Sniff Test"? (Spoiler Alert: No!)

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

But you can't tame the monster of speculative, legalized looting and financialization.

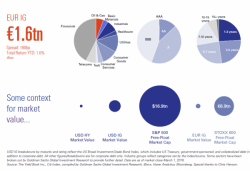

Everything from iron ore to copper to the Baltic Dry Index to stocks to bat guano is rallying. The problem is not a single rally passes "the sniff test:" is the rally the result of changing fundamentals, or is it merely short-covering and/or speculative hot money leaping from one rally to the next?