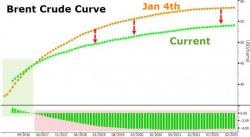

Crude Curve Collapse Signals Producers Losing Faith In Oil Recovery

"They don't quite trust the higher spot prices yet," warned one trader as the changing shape of the Brent forward curve suggests oil producers have been locking in recent gains across the crude futures price structure.

As Reuters reports, producers - who have been hoping that a 20-month price rout has bottomed out - do not have full confidence that a recovery is underway, as seen by the shape of the Brent forward curve out to the year 2020.