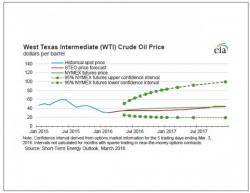

Crude Chaos As Cushing Inventories Rise For 6th Straight Week

Following Genscape's projection that Cushing inventories rose less than expected, various sources on Twitter report that API sees a 4.4mm build (in line with expectations of a 3.9mm build) after EIA's massive build of over 10.3mm barrels last week. Cushing saw a 692k build - the 6th week in a row but gasoline and distillates saw a draw. Crude sold off all day as the short-covering squeeze ended but as the data hit, WTI dipped, ripped, and dipped again... only to rally once more...

API