Gold Screams (But What's It Saying?)

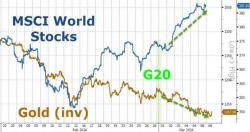

As global stock markets have soared in recent weeks, accelerating most recently after the dud of the G-20 meeting, gold has also rallied, strongly suggesting there is anything but confidence in this ramp.

So Gold Is Screaming, but as ConvergEx's Nick Colas asks, What Is It Saying?

Gold is up 19% so far in 2016, with prices making new one-year highs just in the past week. That shouldn’t be happening.