Spread Betting Shares Plunge As EU Regulator Unveils Trading Crackdown

With two weeks to go before the implementation of the EU’s dreaded new regulatory overhaul, MiFID II has struck again...

With two weeks to go before the implementation of the EU’s dreaded new regulatory overhaul, MiFID II has struck again...

Content originally published at iBankCoin.com

They will play this interview in Harvard's Business School program for centuries to come on what exactly not to do and saying during a nationally televised interview.

Longfin CEO makes a good case for short sellers: 'We do not deserve this market cap." $LFIN pic.twitter.com/OEmIU3yHTC

— The_Real_Fly (@The_Real_Fly) December 19, 2017

Here we go again...

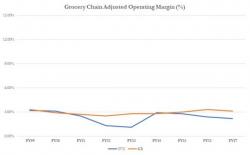

Over the summer, we argued that the grocery business in the U.S. is, and always has been, a fairly miserable one. From A&P to Grand Union, Dahl's, etc., bankruptcy courts have been littered with the industry's failures for decades.

The reason for the persistent failures is fairly simple...razor-thin operating margins that hover around 1-3% leave the entire industry completely incapable of absorbing even the slightest financial shock from things like increasing competition and food deflation.

Authored by Tsvetana Paraskova via OilPrice.com,

After years of setbacks and delays, China may be days away from launching a yuan-priced crude oil futures contract to make its currency more international and challenge the dominance of the petrodollar.

Many Chinese investors eagerly anticipate the start of yuan oil futures trading on the Shanghai International Energy Exchange, with hope it will come just in time for Christmas, when western markets will be either closed or calmer than usual.