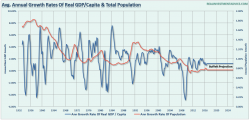

Growing "Signs Of Distress" In US Manufacturing Data Demolish Decoupling Dream

Following the weakness in global PMIs, and yesterday's Chicago PMI collapse, US Markit Manufacturing PMI dropped to cycle lows at 51.3 from 52.5 (very slightly better than expectations of 51.2) with job growth at 5-month lows, production at slowest in 28 months, and work backlogs tumbling to the lowest since Sept 2009.