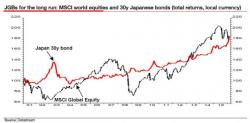

Albert Edwards Is In Love With This Asset That Hasn't Had A Losing Year Since 2007

Albert Edwards is in love, but what makes it somewhat awkward is that the object of his affection is not living flesh and blood but a major asset, one which he calls "probably the most fantastic investment of the last decade", and one which so many others have called the "widowmaker" for the simple reason that they have shorted it, shorted it again, and shorted it some more, only to always lose money because as their adversary that have the most irrational, most childish and most desperate central bank in the world: the Bank of Japan.