Where Negative Interest Rates Will Lead Us

Submitted by Patrick Barron via The Mises Institute,

Submitted by Patrick Barron via The Mises Institute,

Something is broken in the US bond market.

One day after the NY Fed unexpectedly announced yesterday's Agency MBS POMO was cancelled (then rescheduled to later in the day) due to "technical difficulties", moments ago the US Treasury announced that with 10 minutes to go before today's 7 Year auction, that the auction is being rescheduled for tomorrow due to, drumroll, "technical issues."

This is the full statement it said:

NEW CLOSING DATE AND TIMES FOR TODAY'S 7-YEAR NOTE AUCTION

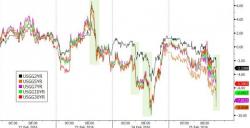

It appears yesterday's "capitulation" lows in Treasury yields... weren't.

Dear Citigroup employees, we suggest you stop reading this post right now or else you may find that the enclose dose of reality, pardon, permabearishness is precisely what you all want.

For everyone else, here is the latest rant by Richard Breslow explaining not only why traders are frustrated in a market in which nothing makes sense, but but where after holding their hands for years, central bankers have finally forsaken the 20 year old hedge fund managers:

Submitted by Eric Bush via Gavekal Capital blog,