"Reversal Risk": Goldman Documents The History Of Central Bank Backpedaling

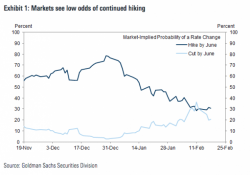

In December, Janet Yellen hiked right into what might as well be a recession in what Marc Faber suggests will go down as one the most ill-timed policy maneuvers in the history of central banking.

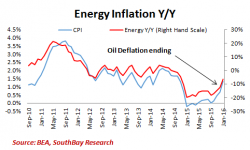

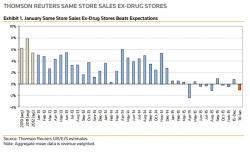

Things didn’t fall apart immediately, but the situation started to deteriorate markedly at the beginning of last month when collapsing crude prices and a bungled attempt to implement a circuit breaker in China triggered harrowing bouts of volatility across markets and set investors up for one of the most inauspicious starts to a year in history.