Silver Linings: Keynesian Central Banking Is Heading For A Massive Repudiation

Submitted by David Stockman via Contra Corner blog,

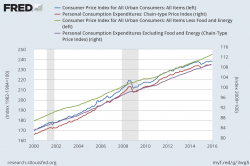

For several years now the small coterie of Keynesian academics and apparatchiks who have seized nearly absolute financial power through the Fed’s printing presses have justified the lunacy of unending ZIRP and massive QE on the grounds that there is too little inflation. The bureaucrats at the IMF even invented a lame-brained catch-phrase, calling the purported scourge of money which retains most of its value “lowflation”.