Stephen Roach: "Central Banking Has Lost Its Way, Is In Crisis"

Authored by Stephen Roach, originally posted at Project Syndicate,

Authored by Stephen Roach, originally posted at Project Syndicate,

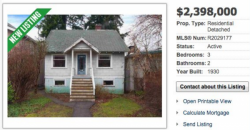

Three weeks ago, when observing the ongoing lunacy in the Vancouver housing market, we mentioned the case of Canadian Bill Ring, head of operations for a property management company who, as Bloomberg quotes, said "I don’t want to invest in stocks because they’re crazy and real estate is a solid, safe investment."

Much to our chagrin we mocked Bill's zest, adding that "if the housing market in Canada were overheating, you wouldn't be able to get "bargains" like the listing shown below from Vancouver."

Gold is many things to many people. A perennial battleground subject, gold remains arguably one of the most debated asset classes across global financial markets, but as Goldman's precious metals equity analyst notes, from a fundamental perspective, the risk/reward looks more balanced than that of its bulk and base metal peers, especially in terms of the supply/demand dynamics.

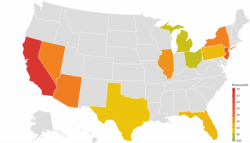

Americans are in debt. And massively so.

In fact, the US is laboring under $1.1 trillion in auto loan debt and $1.3 trillion in student loan obligations.

This massive burden may well be holding back the beleaguered consumer in the US, a country which depends on consumer spending for three quarters of economic growth.

The push to ban cash, in particular notes with a high denomination (such as $100 dollar bills), is picking up momentum. The European Central Bank President announced earlier this week that Europe is strongly considering phasing out the 500 euro note. Sovereignman.com reports: Yesterday, former US Treasury Secretary Larry Summers published an op-ed in the Washington Post about getting rid of the $100 bill. Prominent economists and banks have joined the refrain and called for an end to cash in recent months.