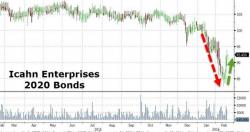

Irony? "Credit Crash Warning" Icahn May Be Cut To Junk By S&P

Having warned - correctly - of the impending collapse of the US credit markets last year, it just seems ironic that Carl Icahn's firm has been downgraded to "watch negative" from stable by S&P, implying a cut to junk may be imminent. Just as we detailed earlier, activist investors have suffered greatly in the oil rout, and S&P cites declining investment values in the firm's portfolio, which have smashed the loan-to-value ratio up to 45% (a crucial threshold for the ratings agency).