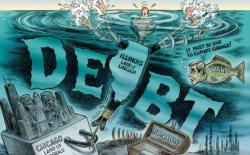

Moody's Considers Municipal Ratings Changes That Could Push Illinois Into Junk Territory

A few weeks ago, we expressed some level of astonishment that the rating agencies, in their infinite wisdom, decided to bestow an investment grade rating upon a new $3 billion bond issuance by the City of Chicago. Of course, this wouldn't be such a big deal but for the fact that the state of Illinois is a financial disaster that will undoubtedly be forced into bankruptcy at some point in the future courtesy of a staggering ~$150 billion funding gap on its public pensions, a mountain of debt and $16.4 billion in accrued AP because they can't even afford to pay their bills on a timely basis.