“Gold was like a beach ball that had been pushed too low in the water and is now bouncing higher with a vengeance”

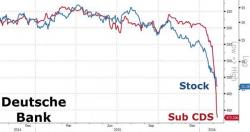

Gold fell $2.40 to $1,187.80 yesterday. It remained resilient despite Chinese markets being closed due to strong physical demand and concerns about the global economy, the banking sector and the risks of a new global financial crisis.

Gold jumped $34.70, or 3%, to $1,192.40 an ounce on Monday and registered its best single-session point and percentage gain since December 2014.