Deutsche Bank Stock Crashes To Record Low

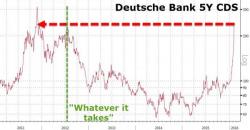

Moments ago, in response to DB's open querry on Twitter whether the Dax is "overreacting", we highlighted DB's soaring CDS and asked if perhaps the market was not underreacting.

Minutes later the market opined, by sending DB stock to new all time lows.

"Worse than Lehman..."

And that has crushed the entire Geman stock market...