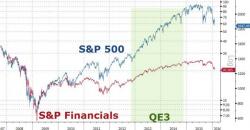

Either Banks Are Cheap... Or The Market's Gonna Crash

Large cap financials have had an awful time in the last month and are 11.7% lower so far in 2016.

As ConvergEx's Nick Colas details, that’s worse than pretty much anything else, including all other S&P 500 sectors, the Russell 2000 small cap index, and even the MSCI Emerging Markets Index.