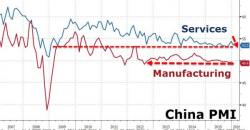

It didn't take much to fizzle Friday's Japan NIRP-driven euphoria, when first ugly Chinese manufacturing (and service) PMI data reminded the world just what the bull in the, well, China shop is...

... leading to a 1.8% drop on the first day of February after Chinese stocks slid 23% in January with the nation’s manufacturing sector faces strong galewind challenges as the government plans to reduce excess industrial capacity and unleash troubling mass unemployment, while a weakening currency is spurring capital outflows.