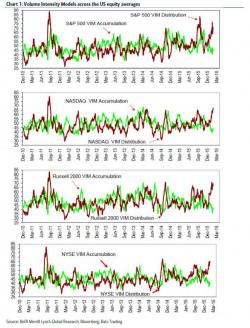

Ignore Day To Day Market Spikes: Are Stocks Being Accumulated Or Distributed?

While on any given day, stocks may tumble or surge as marginal buyers send increasingly illiquid indices lower or higher on ever lower volume, a more important question is what is taking place below the surface: are large holders looking to offload large exposure (by selling), or vice versa.

For the answer we go to Bank of America, which has models to measure precisely this.