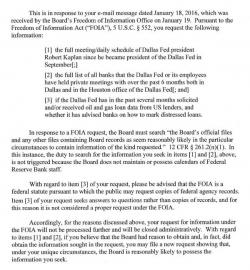

Dallas Fed "Responds" To Zero Hedge FOIA Request

Two weeks ago, Zero Hedge reported an exclusive story corroborated by at least two independent sources, in which we informed our readers that members of the Dallas Federal Reserve had met with bank lenders with distressed loan exposure to the US oil and gas sector and, after parsing through the complete bank books, had advised banks to i) not urge creditor counterparties into default, ii) urge asset sales instead, and iii) ultimately suspend mark to market in various instances.