Shale Shock: Another Leg Lower In Oil Coming After Many Producers Found To Have Far Lower Breakevens

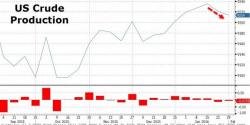

One of the great unknowns facing the US shale industry, and threatening the recurring rumors of its imminent demise, is how it is possible that despite the collapsing number of oil wells, and despite the plunge in crude prices which supposedly are well below all-in shale production costs, does production not only refuse to decline, but in fact has been largely increasing in the past 6 months, with just a modest decline in recent weeks.