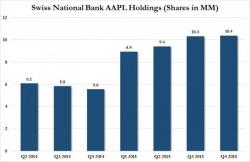

The Swiss National Bank Doubled Its Holdings Of AAPL Stock In 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses - largest hedge fund in Switzerland, its central bank, the Swiss National Bank.