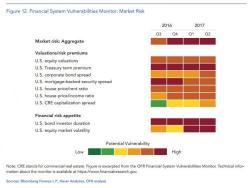

Dear Janet Yellen: Here Is Your Own Watchdog Warning About Financial Stability Risks In "Red And Orange"

In the most interesting exchange during Janet Yellen's final news conference, CNBC's seemingly flustered Steve Liesman asked Janet Yelen a question which in other times would have led to his loss of FOMC access privileges: "Every day it seems the stock market goes up triple digits on the Dow Jones: is it now, or will it soon become a worry for the central bank that valuations are this high?"