"Liar Loans" Are Back In 2007 Housing Bubble Redux

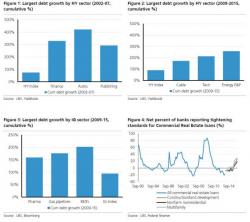

In the leadup to the financial crisis, lenders did some pretty silly things.

The securitization bonanza and the attendant proliferation of the “originate to sell” model drove lenders to adopt increasingly lax underwriting standards.

Put simply, the pool of creditworthy borrowers is by definition finite. That’s a problem because the securitization machine needs feeding. So what do you do if you’re a lender? Why, you expand the pool of eligible borrowers by making it easier to get a loan.