Crude Sinks To Day Lows After Goldman Explains Why No Oil Production Cuts Are Coming

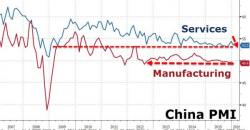

Moments ago, following last week's torrid crude oil price rebound driven entirely by now-denied hopes of some production cut consensus between oil suppliers, namely Russia and Saudi Arabia, oil halted its four-day rally as weak Chinese manufacturing data added to economic demand concern.

“The risk seems to be the greatest on the downside again” and speculation of OPEC production cuts has “faded fast,” says Saxo Bank head of commodity strategy Ole Hansen. “China and South Korea are both helping the market return to fundamental focus where it is worried about demand."