When The Fed Put Fails

With Ray Dalio warning that QE no longer works:

"it is difficult to push the prices of these assets up and it is easy to have them fall. And when they fall, there is a negative impact on economic growth. When debt levels cannot be increased without reducing spending — stimulating demand is more difficult."

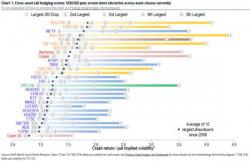

It might behoove some investors to "hedge" as opposed to BTFD in FANGs. As BofAML's Jason Galazidis explains,