I-Owe-Ah & The Crime Called Ethanol

Submitted by Eric via EricPetersAutos.com,

Ethanol – corn alcohol – won’t take you as far as a gallon of gas.

But that doesn’t mean it is isn’t powerful stuff.

Politically powerful stuff.

Submitted by Eric via EricPetersAutos.com,

Ethanol – corn alcohol – won’t take you as far as a gallon of gas.

But that doesn’t mean it is isn’t powerful stuff.

Politically powerful stuff.

Over the past year, we have frequently warned that the biggest financial risk (if not social, which in the form of soaring worker unrest is a far greater threat to Chinese civilization) threatening China, is its runaway non-performing loans, which at anywhere between 10 and 20% of total bank assets, mean that China is one chaotic default away from collapsing into the post "Minsky Moment" singlarity where it can no longer rollover its bad debt, leading to a debt supernova and full financial collapse.

On Friday, we brought you the 4 “D’s” of deflationary doom from BofA’s Michael Hartnett.

For those who missed it, Hartnett says the reason “an almost manic monetary policy been so ineffective at generating a broad, sustained economic recovery,” is that the following four secular deflationary factors are conspiring to impede a robust recovery:

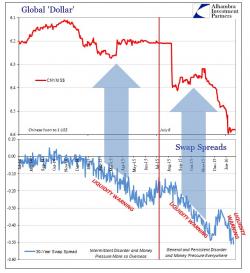

Submitted by Jeffrey Snider via Alhambra Investment Partners,

It makes for quite the juxtaposition, though perhaps not so jarring given that global banks are still enormous and disparate operations. On the one hand, Citigroup’s CEO was eminently confident from within the confines of Davos and the status quo:

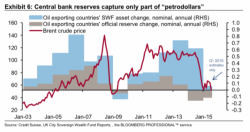

Back in August we explained why the headline figures for EM FX reserves paint an incomplete picture with regard to the UST liquidation among commodity producers and emerging market reserve managers.