And The Market Breaks... Again

Something just broke in the options markets...

- *NYSE AMEX/ARCA OPTIONS INVESTIGATING A REPORTED TECHNICAL ISSUE

Perhaps this is why...

And of course...

Something just broke in the options markets...

Perhaps this is why...

And of course...

While University of Michigan confidence slipped modestly from December's print, the tumble in expectations (hope) from the preliminary print is perhaps more important as stocks dropped and volatility struck. However, more problematic for an inflation-hoping Federal Reserve is the drop in 12-month inflation expectations.

The last time inflation expectations were lower than this was September 2010.. when Bernanke hinted at QE2 at jackson Hole.

By now, not even CNBC's cheerleading permabulls can deny that the US is in a manufacturing recession: in fact, it is so bad that even the staunchest defenders of Keynesian dogma admit what we said in late 2014, namely that crashing oil is bad for the economy.

And yet, the "services" part of the US economy continues to hum right along, leading to such surprising outcomes as a stronger than expected print in Personal Consumption Expenditures. How can this be?

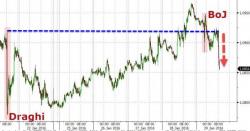

EURUSD just broke 80 pips lower instantaneously as it seems a somewhat delayed reaction to US GDP data sparked panic buying of USDollars (despite Fed Funds futures pricing in no more rate hikes in 2016). At 1.0855, EURUSD is testing the ket 50-day moving-average and is back below pre-Draghi levels...

EURUSD back below pre-Draghi levels...

As Rate-Hike odds for 2016 disappear in a puff of fed policy error...

Submitted by David Stockman via Contra Corner blog,

The fast money and robo-machines keep trying to ignite stock rallies, but they all fizzle because bad karma is beginning to infect the casino. That is, apprehension is growing among whatever adults are left on Wall Street that 84 months of ZIRP and $3.5 trillion of Fed balance sheet expansion, aka money printing, didn’t do the trick.