Hitting The Real Jackpot

Couldn't have happened to a nicer guy?

Source: Investors.com

Couldn't have happened to a nicer guy?

Source: Investors.com

Two months ago, long before the WSJ and the NYT wrote nearly identical pieces, we laid out a list of China risk factors which everyone by now is familiar with. These were as follows:

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

This has three extremely negative consequences.

In response to a recent post on the structural decline in the velocity of money, correspondent Mike Fasano described a key dynamic in both the decline of money velocity and the middle class.

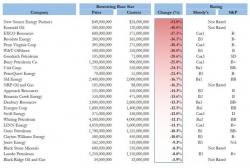

Two weeks ago, we reported that even as U.S. lenders were professing to their investors that there is no risks with their energy exposure and that they are comfortably reserved for any potential losses, they were reducing their unfunded (and total) exposure to oil and gas exploration companies due to balance sheet, default and contagion concerns.

Last week we asked (and answered) whether capitulation was close (the answer - no). Earlier this week, we noted that the equity market remains stubbornly in denial that things could get much worse (even as credit and eurodollar markets suggest otherwise). Today we get a double whammy of confirmation as Goldman warns that the current drawdown could be significantly worse than August's (and markets are not pricing in the risk) and then DoubleLine's Jeff Gundlach warning that "this is not stopping any time soon."