Ignore the technicals at your peril.....

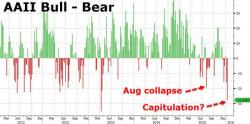

A wide range of stock market and sector indices appear to be forming large and menacing topping-patterns.

To quote Jason Zweig’s “The Devil's Financial Dictionary”, he reminds us that "technical analysis is a method of predicting the future price of a financial asset by looking at its past prices". So far so good, it is doubtful that anyone would disagree with this description. However, the entry goes on to say that technical analysis "is about as reliable as attempting to forecast tomorrow’s weather by studying yesterday’s".