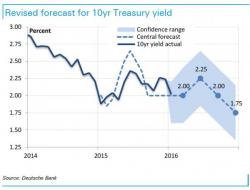

Why The 10Y Yield Will Slide To 1.75%: Deutsche Bank Explains

Two months ago, before the Fed's rate hike was largely perceived as a market-spooking policy mistake, we laid out Deutsche Bank's three stage scenario on how to trade "The Fed's Upcoming "Policy Error", one which could be summarized as follows: the 10Y starts off strong, weakens into the summer to 2.50% on tantrum fears, then proceeds to surge higher as the Fed acknowledges its error, and hits a yield of 2.00% at the end of the year.