For Emerging Markets, It Is Now Worse Than The Asian Financial Crisis

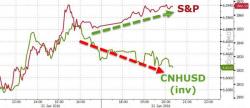

"It’s Black Wednesday for emerging markets," one strategist warned and Thursday is not looking any better, as SocGen's Berg warns "The rout in emerging markets could continue for some time, especially as the major global central banks have exhausted their ammunition in recent years, making it unlikely that they will rescue global markets this time around." In fact, as Bloomberg reports, this year's EM turmoil is already worse than in the same period in 1998's Asian financial crisis (and EM FX is even worse).