Last-Hour Buying-Panic Saves Nasdaq From Longest Losing Streak In 31 Years

It just seemed appropriate...

A 65% tumble for the S&P? https://t.co/QAnEECpuGX pic.twitter.com/rlr67A4qk1

— MarketWatch (@MarketWatch) January 12, 2016

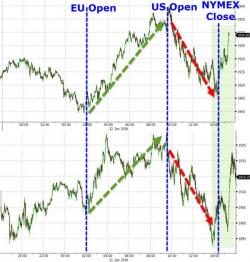

8 down days as of yesterday was longest losing streak since Jan 2008 but a red close today would have made it 9 down days in a row - The longest losing streak for Nasdaq Composite since May 1984

Deja Vu All Over Again...